The last quarter (July-September) has seen most of the economic indicators going for a roller coaster ride in India. In September, Interest Rate was increased yet another time and the Oil Marketing Companies increased the Oil prices once again. Inflation has touched newer heights and the Index of Industrial Output (IIP) plunged to a 21 month low in July.

The rupee has been plummeting on average and the stock market indices have been volatile to say the least.

IIP growth decelerated sharply to 3.3% in July 2011 from 8.8% in June 2011, and from 9.9% in July 2010. The uncertainties in policymaking and the increasing loss of credibility of the UPA government are causing many companies to defer their investment and expansion plans.

The IIP compiled in India has in its scope the Mining, Manufacturing and Electricity sectors. The increasing dependence of the government on debt leaves no doubt in the minds of the companies that the government will not be able to spend on infrastructure and give boost to the economy if need be.

Increasing the interest rates makes borrowings more expensive for the companies and individuals. Hence they postpone or cancel their expansion plans. This results in depleted producer sentiments and reduced capital spending. This in turn results in a further lower IIP.

Owing to high costs of borrowing, a few companies might resort to layoffs or pay-cuts, leaving individuals with lower disposable income. Also, higher interests on deposits might lure individuals to save now and consume later. Both, lower disposable income and higher savings, results in lower consumption, leading to lower sales and profits, lower production, lower IIP, hence, lower stock prices. Looming threat of the US and European nations going back into recession is not helping the situation.

The exports to these nations are bound to be hit. While a falling rupee will benefit the exporters, the demand itself might drop.

The impact of an oil price increase on inflation cannot be ignored as well. It must be noted that increased oil prices directly result in an increase in inflation as it is a major component of the Consumer Price Index. It also results in increased airfares, shipping costs, public transport etc., thereby indirectly increasing the inflation further.

By letting the OMCs increase the price of oil, the government is contributing to a further rise in inflation on one hand, and adding salt to the wounds of the common man by further increasing the interest rates to control the same inflation.

Mr. Pranab Mukherjee was quick to point out that petrol has been deregulated and it is the OMCs who have in their review decided to increase the price. True. But then, who reviews and makes the decisions for these companies? And who benefits from such decisions?

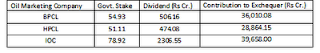

It is clear from Table 1 that the Government being the majority shareholder in these companies, must be approving the price rises. Also, these companies distribute whopping amounts as dividends, not to mention the contribution to the exchequer in the form of taxes and duties (see table 1)!

Table 1:

Source: CMIE prowess database and Annual Reports of the companies

In the year 2010-2011, the amount of subsidies towards petroleum products doled out by the central government was Rs38,400 crores (source: union budget 2011-2012). A look at table shows that the OMCs together pay much more to the government in the form of taxes, duties and dividends.

Our central banker Mr. Subbarao claims that the rise in interest rates would curb inflation. Figure 1 clearly shows that increasing the interest rates have not been able to rein in the inflation in the past one year. So yet another rise in interest rate seems to be in vain.

Figure 1:

What seems to be the case is that the inflation in India is demand driven. So the need of the moment would be to ensure supply, increased productivity and efficiency rather that curbing the demand.

Curbing the demand would not help in achieving the growth targets. It would push the country into a slow growth or recessionary phase. That would be a real shame, considering that we have one of the brightest economists and a man responsible for the India

turnaround story as our current Prime Minister.

Source: RBI

The rupee has been plummeting on average and the stock market indices have been volatile to say the least.

IIP growth decelerated sharply to 3.3% in July 2011 from 8.8% in June 2011, and from 9.9% in July 2010. The uncertainties in policymaking and the increasing loss of credibility of the UPA government are causing many companies to defer their investment and expansion plans.

The IIP compiled in India has in its scope the Mining, Manufacturing and Electricity sectors. The increasing dependence of the government on debt leaves no doubt in the minds of the companies that the government will not be able to spend on infrastructure and give boost to the economy if need be.

Increasing the interest rates makes borrowings more expensive for the companies and individuals. Hence they postpone or cancel their expansion plans. This results in depleted producer sentiments and reduced capital spending. This in turn results in a further lower IIP.

Owing to high costs of borrowing, a few companies might resort to layoffs or pay-cuts, leaving individuals with lower disposable income. Also, higher interests on deposits might lure individuals to save now and consume later. Both, lower disposable income and higher savings, results in lower consumption, leading to lower sales and profits, lower production, lower IIP, hence, lower stock prices. Looming threat of the US and European nations going back into recession is not helping the situation.

The exports to these nations are bound to be hit. While a falling rupee will benefit the exporters, the demand itself might drop.

The impact of an oil price increase on inflation cannot be ignored as well. It must be noted that increased oil prices directly result in an increase in inflation as it is a major component of the Consumer Price Index. It also results in increased airfares, shipping costs, public transport etc., thereby indirectly increasing the inflation further.

By letting the OMCs increase the price of oil, the government is contributing to a further rise in inflation on one hand, and adding salt to the wounds of the common man by further increasing the interest rates to control the same inflation.

Mr. Pranab Mukherjee was quick to point out that petrol has been deregulated and it is the OMCs who have in their review decided to increase the price. True. But then, who reviews and makes the decisions for these companies? And who benefits from such decisions?

It is clear from Table 1 that the Government being the majority shareholder in these companies, must be approving the price rises. Also, these companies distribute whopping amounts as dividends, not to mention the contribution to the exchequer in the form of taxes and duties (see table 1)!

Table 1:

Source: CMIE prowess database and Annual Reports of the companies

In the year 2010-2011, the amount of subsidies towards petroleum products doled out by the central government was Rs38,400 crores (source: union budget 2011-2012). A look at table shows that the OMCs together pay much more to the government in the form of taxes, duties and dividends.

Our central banker Mr. Subbarao claims that the rise in interest rates would curb inflation. Figure 1 clearly shows that increasing the interest rates have not been able to rein in the inflation in the past one year. So yet another rise in interest rate seems to be in vain.

Figure 1:

What seems to be the case is that the inflation in India is demand driven. So the need of the moment would be to ensure supply, increased productivity and efficiency rather that curbing the demand.

Curbing the demand would not help in achieving the growth targets. It would push the country into a slow growth or recessionary phase. That would be a real shame, considering that we have one of the brightest economists and a man responsible for the India

turnaround story as our current Prime Minister.

Source: RBI

No comments:

Post a Comment